2024 Schedule 1040 Instructions Sheet – If you are a sole proprietor, you report your business profit or loss on Internal Revenue Service Schedule C of Form 1040, Profit or Loss From Business. If you sell merchandise or manufacture a . We’re excited to welcome you to your new home on campus! Time to start planning and get ready to move in. Move-in on campus is an exciting time of year. It is filled with excitement, happy tears, and .

2024 Schedule 1040 Instructions Sheet

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.govPrintable IRS Tax Forms for 2023, 2024: Simplifying Tax Season

Source : fox59.com1040 (2023) | Internal Revenue Service

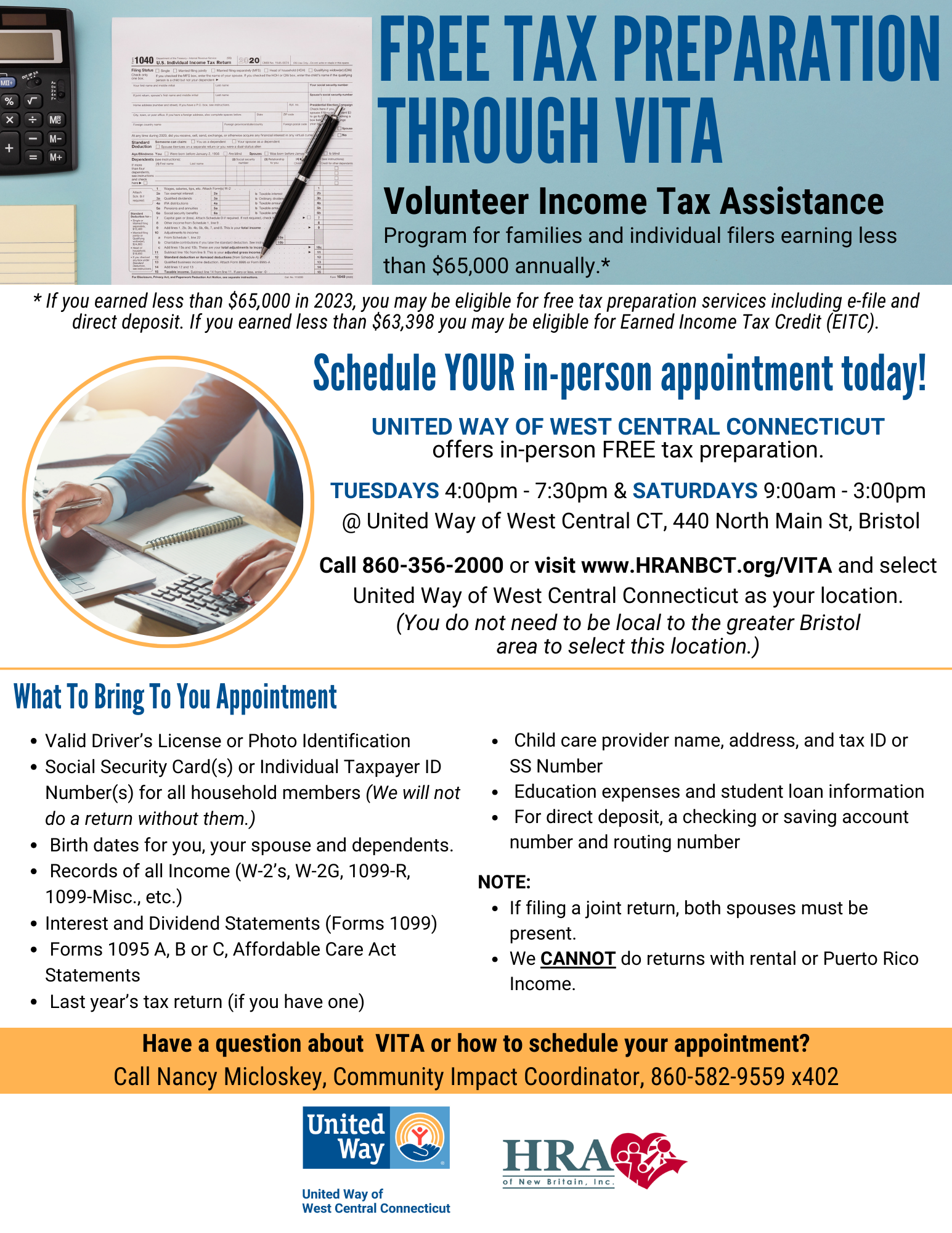

Source : www.irs.govFree Tax Preparation Service | United Way of West Central Connecticut

Source : www.uwwestcentralct.org1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 Form 1040 SR

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govHow to Claim Missing Stimulus Money on Your 2020 Tax Return

Source : www.aarp.org2024 Schedule 1040 Instructions Sheet 1040 (2023) | Internal Revenue Service: They key to using Schedule C to create a balance sheet is separating your personal finances from your small business. Therefore, it is best to pay yourself a salary separate from your profits . The Days and Times listed follow the approved schedule of standard times. This is a free-range column to include anything you may want to note. You may use this column to indicate any of the following .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)